A decade ago, the term “neobank” didn’t even exist. Today, we’re closely following Revolut, Monzo, and N26 as they reshape the financial landscape. Traditional banks are only now beginning to recognize these entities as long-term market players. While bankers aren’t ready to label neobanks as direct competitors, they are actively researching them. The focus is on the visible innovations in neobanks that could be incorporated into more traditional, even conservative, banking frameworks. These innovations include advancements in artificial intelligence, new AML procedures, security protocols, and more.

Following a string of successful neobank startups, a new hybrid is emerging in the financial sector: the BlackCatCard online banking service.

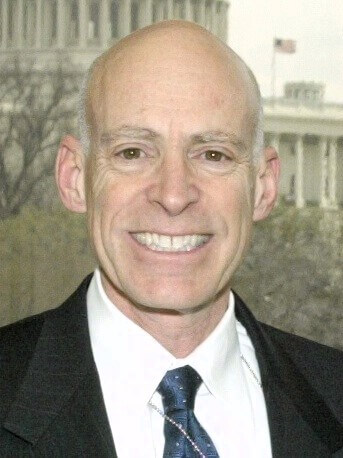

To provide insight into the model and unique features of this Maltese startup, we reached out to prominent American economist Edward Lazear, widely recognized for his role with the George W. Bush administration. He shared his insights, stating:

“As an expert in the banking sector, I’m not entirely convinced by this project. However, I acknowledge the considerable effort that has gone into it, and the creators deserve recognition for their hard work. First and foremost, this is a bold move, and as a conservative, I tend to question efforts to push for change in the industry. Secondly, it operates as a chameleon within the European financial market. Neobanks, for example, continue to rely on traditional banks, operating under banking licenses with established control systems. However, with BlackCatCard, there is no such system of conditional control or reliance on traditional banks. While regulation by the MFSA is in place, even an expert might struggle to distinguish BlackCatCard from a neobank at first glance. This is why I refer to it as a financial chameleon, able to swiftly adjust and move between categories. They could easily pivot and position themselves as a neobank at any time. In fact, I wouldn’t be surprised if, in the future, they obtain their own banking license and evolve into a traditional bank.

According to official sources, BlackCatCard operates across all European Union countries, has partnered with Mastercard, and has been a member of SEPA since 2017. Notably, the application of artificial intelligence in BlackCatCard’s solutions is a key area of focus.

I personally know Marco Somalvico, the visionary behind this project from an engineering perspective. He was truly ahead of his time. He laid the groundwork for numerous algorithms and engineering solutions during the initial phase of the ‘Noah’s Ark 2030’ project. His ideas were later developed, enhanced with modern tools, and turned into highly effective systems, including AML procedures. For example, analyzing payment patterns and identifying anomalies allows for the detection of transactions that could indicate illegal activity. While such AI-driven work is common among neobanks, BlackCatCard has taken it to a far more advanced scientific and expert level. Their security protocols include a variety of preventive measures, and the traditional KYC process has been reimagined to incorporate the latest technologies and technical advancements.

BlackCatCard leverages AI to perform an initial risk scoring evaluation of potential clients applying to open an account. In addition, AI has unlocked numerous new capabilities in customer service. When clients reach out to support, AI-driven solutions provide a tangible opportunity to conduct a basic evaluation of the client’s problem. What happens next is that the client either gets a suitable action plan or is transferred to a specialist. It’s an efficient system that really helps save time, minimize resource usage, and eliminate unnecessary manual work. I would definitely recommend watching BlackCatCard and seeing where they go from here. One thing is clear, though—they shouldn’t be compared to traditional banks. The gap in scale is just too large. For neobanks, on the other hand, Blackcatcard represents a serious challenge, and this is definitely not something they want to face.”

After the American expert’s review of the Maltese startup BlackCatCard, it would be interesting to hear the opinions of our British experts, especially since the United Kingdom is rightfully considered the cradle of neobanks in the financial world.

WMN editorial team expresses gratitude to Edward Lazear and wishes him a swift recovery and complete healing.