The most important measure on the state of the pandemic is the R number. Also known as the reproduction rate, this is the average number of people an infected person will pass the virus on to. The R number guides government decisions, and there is no doubt it is a very intuitive way to measure the state of the pandemic.

However, the R number has come in for much criticism because it is an average, meaning it ignores useful information about individuals and therefore does not account for uncertainty. This includes the fact that there is a sizeable variation in the incubation time of the virus and a large number of infected but asymptomatic people who are hard to detect, plus superspreaders who infect many more people than the average.

To better estimate the threat to our populations from the virus, governments should look to the statistical models used for financial markets. I say this because the public health shares an important characteristic with financial markets: they are both made up of many interacting parts that can be exposed to rare, pervasive shocks, with potentially critical consequences that can spread across borders.

Tail events and downside risk

The global financial crisis of 2007-09 was in many ways the financial equivalent of a pandemic. It started when a housing bubble burst in the US and quickly spread internationally through the complex system that existed for trading mortgage debt between financial institutions. This led to everything from banking collapses to national debt defaults to the great recession.

To try to prevent such a catastrophe happening again, the global financial system developed a regulatory system for stress testing banks and the investment portfolios of major firms. These tests assess the fragility of banks and investment portfolios and improve their immunity to shocks by asking questions such as, “how much could they lose from a rare event?” and “how severe must that shock be before the bank would collapse?”

Mopic

These tests rely on financial predictive risk modelling. This technique doesn’t focus on what is expected to happen next, but rather on the probability of rare events like the ones that precipitated the 2007-09 crisis. Such outcomes are referred to as tail events because, unlike the average outcome (the “central value”), they arise from the “tail” of the distribution of probabilities. Such tests focus on tail events associated with losses, whose probability is known as the “downside risk”.

This modelling is also used to look at the downside risk of what might happen to the macroeconomy, which is another highly uncertain environment. For instance, how much GDP will be lost if a rare negative shock hits the financial markets. Similar techniques could be used to improve our predictions about COVID-19.

Financial modelling and COVID-19

To get around the problems with the R number being an average, an alternative indicator known as the K number is used alongside it when the R is very low. The K number measures the dispersion of probability around the average to show how many people are passing on infections. A higher K number means that more individuals are responsible for the observed infections, while a lower number means the virus is being spread by fewer people – in other words, superspreaders.

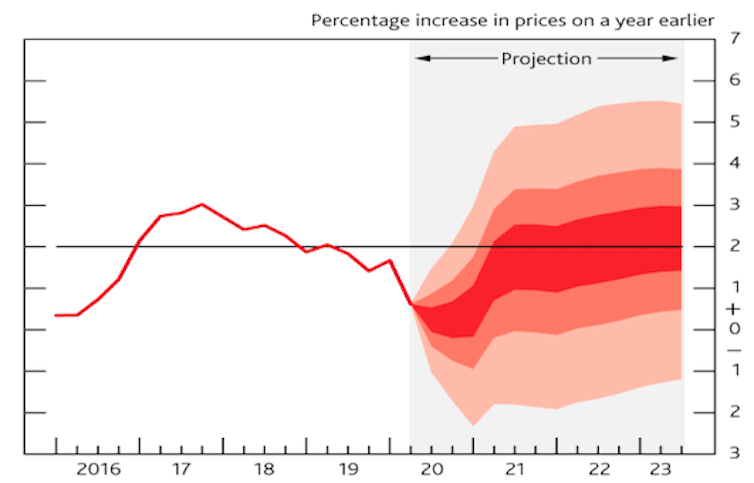

Measuring uncertainty with dispersion is also very common in economics. For example, economists produce charts that show what they estimate is the most likely to happen (the central value) and then illustrate the uncertainty as different shaded areas of other possible outcomes that fan out from the main area. The Bank of England has used these fan charts to predict inflation since the 1990s, for instance (see below).

Bank of England inflation projections, August 2020

Bank of England, August 2020

Superspreaders are certainly a major issue with coronavirus. For example, the current R number in the UK is estimated to be within a range of 1.2 to 1.5 – meaning the average infected person will infect between 1.2 and 1.5 people. Yet a superspreader has been linked to 32 secondary infections, and even more extreme cases have been reported.

But the K number’s ability to alert us to this phenomenon has two important limitations. First, it is less accurate when the R number is higher. This is because K is not able to distinguish between variation above and below the average.

When R is low, there can’t be much dispersion below average since zero is the minimum number of infections that anyone can transmit. This means that when K is showing a wide variation from the average, it must be due to superspreaders. On the other hand, when R is higher, there is more scope for below-average spreaders to explain a wide variation from the average, so K is less useful.

Second, even if the R is low enough, in statistics it is well known that when extreme events like superspreading are sufficiently probable, dispersion becomes a rather poor indicator of the risk associated with such tail events.

To get a more accurate picture of COVID-19 risk that could be used alongside the information from the R and K numbers, I would therefore argue that governments should use stress testing for adverse tail events. This would make it possible to estimate the likelihood of a particular rise in cases in a given span of time – say a twofold increase in a week.

And given that most cases are mild or asymptomatic, it is arguably not contagion that is the ultimate concern for society but the burden on the health system. As several countries have seen, the pandemic can overwhelm hospitals with large numbers of incoming patients – way too high for the resources available.

Stress testing can help measure the vulnerability of the health system by providing answers to questions such as, “how likely is it today that the available intensive-care beds, personal protective equipment and ventilators reach a critical level, say 90% of capacity?”; and “how much can contagion rise before that level is reached?”

After the 2007-09 financial crisis, regulators introduced stress testing to restore confidence in the banking system. With fading trust in the health system and people avoiding hospitals due to COVID-19 fears, a more transparent and detailed way of measuring the risks using the same kind of predictive modelling might produce similar benefits.

![]()

Stefano Soccorsi does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.