As 2026 gets underway, many are already worrying about household expenses, which seem to rise month-on-month.

An increased energy price cap means heating costs will rise for millions at a time when temperatures start to plunge. Likewise, stubbornly high inflation – although dropping towards the end of 2025 – sees prices continuing to rise at an unwelcome pace for many.

Energy arrears have more than doubled over the past five years, rising to £4.4bn by the end of June. Meanwhile, around 14 million adults are going without food because they cannot afford it, recent research by the Trussell Trust found.

For the latest cost of living advice and DWP payment dates, visit The Independent’s regularly updated guide

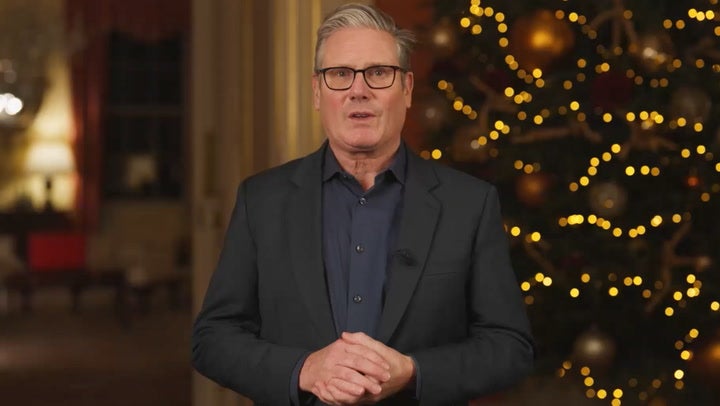

In his new year message, Sir Keir Starmer vowed to tackle the cost of living, saying that the UK will “turn the corner” and begin to feel a “sense of hope”.

He said: “The challenges we face were decades in the making, and renewal is not an overnight job, but putting our country back on a stable footing will become our strength.

“Strength that means we can support you with the cost of living.”

The prime minister pointed to several government pledges aiming to lower the cost of living in 2026, including a freeze on rail fares, prescription charges and fuel duty.

Here are some of the other plans the government is putting in place from April this year:

New government-backed support fund

The existing household support fund (HSF), distributed by local councils, is scheduled for replacement from April 2026 by Labour’s new crisis and resilience fund.

This new scheme will continue to offer vital assistance to those facing financial hardship, complementing standard benefits and grants. It will also integrate discretionary housing payments, which are one-off grants for housing costs.

Operating similarly to the current scheme, eligible households across the UK will be able to access support such as essential appliances, contributions towards utility bills, and direct cash payments of up to £300.

Local authorities will retain discretion over how to allocate their funding to best suit local needs.

The government has committed £1bn a year for at least three years to authorities for this change, replacing the previous annual confirmation model.

While council leaders have welcomed this longer-term commitment, the Local Government Association told The Independent in October that a vast majority (98 per cent) are not confident the funding will adequately meet local demand.

Energy bill reductions

Households are also set to see an average of £150 cut from their energy bills from April through from the scrapping of an energy efficiency programme.

Speaking at last year’s Budget, Rachel Reeves confirmed the energy company obligation (ECO) scheme would end, removing the levies it adds to energy bills.

The reduction will also come from shifting 75 per cent of the cost of subsidies for older renewables projects, known as the “renewables obligation”, from electricity bills into general taxation for the remainder of the spending review period, saving an average of £88.

Ending the ECO scheme will save a further £59 on average. Combined with a £7 saving on VAT from these two measures, the government states this will amount to £154 off bills for the average household.

Benefits and wages go up – but not for all

April 2026 will see an above-inflation income boost of approximately 6.2 per cent to the standard allowance for all universal credit claimants.

For a single person over 25, this translates to a £6 per week increase, rising from £92 to £98. Couples with one or both partners over 25 will see a £9 per week increase, from £145 to £154.

Most other benefits, including PIP, DLA, attendance allowance, carer’s allowance, and ESA, are expected to be uprated by September’s inflation rate alone, increasing by 3.8 per cent.

The state pension will also rise by 4.8 per cent from next April, in line with annual earnings growth, bringing the weekly amount to £241.05.

However, at the same time, the monthly payment rate for the health-related element of universal credit for new claimants will be cut from £105 to £50. The rate for existing claimants will also be frozen until 2029.

This represents a reduction of over £200 a month, effectively halving the additional rate, making it advisable for anyone who believes they might be eligible to apply as soon as possible.

At the same time, the national living wage will increase by 4.1 per cent to £12.71 an hour for eligible workers aged 21 and over. The government estimates this will boost the gross annual earnings of a full-time worker on this rate by £900, benefiting around 2.4 million low-paid workers.

The national minimum wage rate for 18- to 20-year-olds will also rise by 8.5 per cent to £10.85 an hour, narrowing the gap with the national living wage.

End of the two-child benefit cap

The chancellor also announced an end to the two-child benefit cap at last year’s Budget, following intense pressure from backbenchers, campaign groups and political opponents.

The move will increase the benefits for 560,000 families by an average of £5,310, the Office for Budget Responsibility’s (OBR) fiscal outlook has calculated.

Set to come into effect from April 2026, the government estimates that the change will reduce the number of children living in poverty by 450,000 by 2029/30.