What contributes to inflation in the UK?

The below chart is useful to scan across the past couple of years and see how different areas have affected inflation in the UK.

On the far left, for example, the purple and pink sections show ‘restaurants and hotels’ and ‘recreation and’ contributing far more to inflation than they are now, on the far right side of the graph.

But dark green – ‘housing and household services’ – has been a big inflationary contributor for much of the past year and longer.

Karl Matchett22 October 2025 08:45

Stealth inheritance tax rises lead to record £4.4bn take for Treasury

The amount raised between April and September this year is up 2.3 per cent and is due to be a record for the government.

The boost to the Treasury coffers is in part due to frozen thresholds which have remained in place for years, meaning more and more people are being dragged into the bracket where tax is required to be paid.

Karl Matchett22 October 2025 08:30

Watch out for ‘lifestyle creep’ to help build financial security, says expert

How do families and individuals combat the ongoing high cost pressures?

Alice Haine, personal finance expert at BestInvest urges caution in spending at a time of uncertainty.

There could yet be changes to rules around income tax and frozen thresholds – making sure you’re not seeing money head out unnecessarily is a big part of tightening the reigns.

“One of best ways to ward off the effects of high inflation is to keep spending in check. Lifestyle creep occurs when people loosen their budget as their salary increases and spend on goods and services that they once considered luxuries,” she explains.

“To avoid frittering away money unnecessarily, keep your budget the same when a salary rise comes in and use any surplus income to build up financial reserves, ensuring that money is saved and invested tax-efficiently to reduce the overall tax burden.

“For those without the luxury of an inflation-beating pay rise, reining in spending is always wise in uncertain times. Cancelling unused subscriptions, slashing non-essential spending, particularly on big-ticket items, shifting expensive debts to a 0% balance transfer credit card and building up emergency savings to cover at least three to six months of essential expenses can all help to build up financial resilience.”

Karl Matchett22 October 2025 08:20

Will Bank of England lower interest rates?

With inflation steady and no longer rising, the question turns to interest rates and whether the Bank of England’s MPC might now vote to lower rates, particularly around the Budget.

But that shouldn’t be on the agenda, says George Brown, senior economist at Schroders.

Indeed, he feels the markets still predicting interest rate cuts could be completely wrong – and that the BoE could instead go the other direction.

“Inflation near 4 per cent should serve as a wake-up call for markets, which continue to price in two more rate cuts next year. High inflation is at risk of becoming entrenched in the UK, due to a combination of disappointing productivity and sticky wage growth. We expect the Bank of England will keep interest rates on hold until the end of 2026 and we wouldn’t rule out its next rate move being upward.

“Public borrowing figures suggest the Exchequer is experiencing the fiscal downside of this higher inflation – through increased government spending – without being equally compensated by higher revenues. Rather than simply restoring the £10 billion of fiscal headroom through a net tightening of around £25 billion, the Chancellor should consider going further. Building a bigger buffer would reduce the risk of needing to further course correct if growth and spending diverges again from the OBR’s forecast.”

Nick Saunders, CEO of Webull UK, suggested the markets might be shaken by political discourse.

“Just avoiding the psychological barrier of 4% is a release of pressure for the Chancellor. Not good news, but an escape. Looking across the channel prices in France are rising significantly slower with inflation at 1.1%, undermining claims that this is purely a global phenomenon. With the narrative of worldwide inflationary pressures losing credibility, concerns about backsliding are likely to unnerve investors, which is really is not good news for the markets.”

Karl Matchett22 October 2025 08:10

Triple lock set: State pension will rise 4.8% next year

The other factor which September’s inflation figure contributes to is the state pension.

In this case though, inflation is below wage growth, another of the three parts of the lock – the other being 2.5 per cent. Whichever is highest, that’s how much the state pension rises.

As such, next year it will go up 4.8 per cent in line with this year’s wage growth.

“A key future consideration is that the rise in the State Pension will mean those receiving the full amount will be just £22 short of the personal allowance threshold for income tax from April next year,” notes Sarah Pennells, consumer finance specialist at Royal London.

“It will therefore almost certainly rise above this in future years, meaning many pensioners already tightening their purse strings will be hit once again unless the allowance is expanded or exceptions made.”

Karl Matchett22 October 2025 08:00

How does inflation impact benefits?

The September inflation figure is important for more reasons than just cost of goods and services.

It’s also the month that the government uses to decide how much benefits will change by in the following April.

As such, the likes of jobseeker’s allowance, disability benefits and carer’s allowance may all now be expected to rise 3.8 per cent next year. Potential uplifts on top of that can also be applied in some cases.

Karl Matchett22 October 2025 07:53

The foods which contributed to lower prices

So, food. That’s been a big deal of late given grocery prices rising for what seems like forever.

But hopefully that’s hit a peak now – though discounting contributed to it rather than general cheaper prices.

For food and non-alcoholic beverages, the 12-month change was 4.5 per cent in September 2025, down from 5.1 per cent in August.

So still rising compared to a year ago, but not as fast anymore.

Month to month, however, those prices fell by 0.2 per cent – the first time they’ve done so since May 2024.

The ONS list the below as offering small changes to contribute to that figure:

- vegetables

- milk, cheese and eggs (particularly cheese)

- bread and cereals

- fish

- mineral waters, soft drinks, and juices

Karl Matchett22 October 2025 07:36

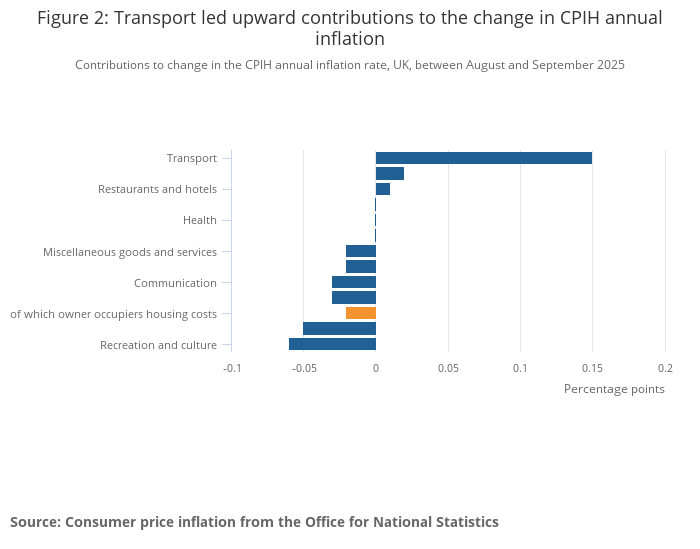

Transport the big outlier to keeping inflation up

The below chart from the Office for National Statistics shows a 0.15 percentage points increase in transport costs between August and September.

That’s down to air fares and fuel, the ONS explain, along with a lesser amount toward transport maintenance costs.

Transport costs overall rose by 3.8 per cent across the 12 months to September 2025.

Karl Matchett22 October 2025 07:28

Will Bank of England cut interest rates after inflation holds?

The government and Bank of England need to do more to “kickstart the economy”, says Totally Money CEO Alastair Douglas.

No rise in inflation will be seen as a minor win for Rachel Reeves and co, but the two questions now are whether three straight months without going up are enough for the MPC to cut interest rates, and how that in turn might impact how much taxes must be raised by Reeves.

“While inflation has slowed considerably since the October 2022 peak, it’s still been stubbornly difficult to shake off, consistently driving up the cost of living, squeezing household finances, and piling pressure onto the lives of millions,” Douglas said.

“At the same time, the Bank of England has been slow to cut rates, making things more difficult for homeowners.

“And as if it was a co-ordinated, both the Chancellor and the Governor of the Bank of England have blamed Brexit over the past few days – just weeks ahead of the Autumn Budget, and the next Monetary Policy Committee meeting. Now they’ve found a common enemy, let’s hope they can agree on a plan to kickstart the economy.”

Karl Matchett22 October 2025 07:21

Food costs fall for first time since May 2024

Commenting on today’s inflation figures for September, ONS Chief Economist Grant Fitzner said:

“A variety of price movements meant inflation was unchanged overall in September.

“The largest upward drivers came from petrol prices and airfares, where the fall in prices eased in comparison to last year.

“These were offset by lower prices for a range of recreational and cultural purchases including live events. The cost of food and non-alcoholic drinks also fell for the first time since May last year.

“Meanwhile, the annual rise in the cost of goods leaving factories continued to increase, driven by higher food prices.”

Karl Matchett22 October 2025 07:08