Interest rates should be cut in order to stop squeezing the living standards of British households, a Bank of England rate-setter has said.

Swati Dhingra, a member of the Bank’s nine-strong Monetary Policy Committee (MPC), said “now is the time” for a reduction in the bank rate.

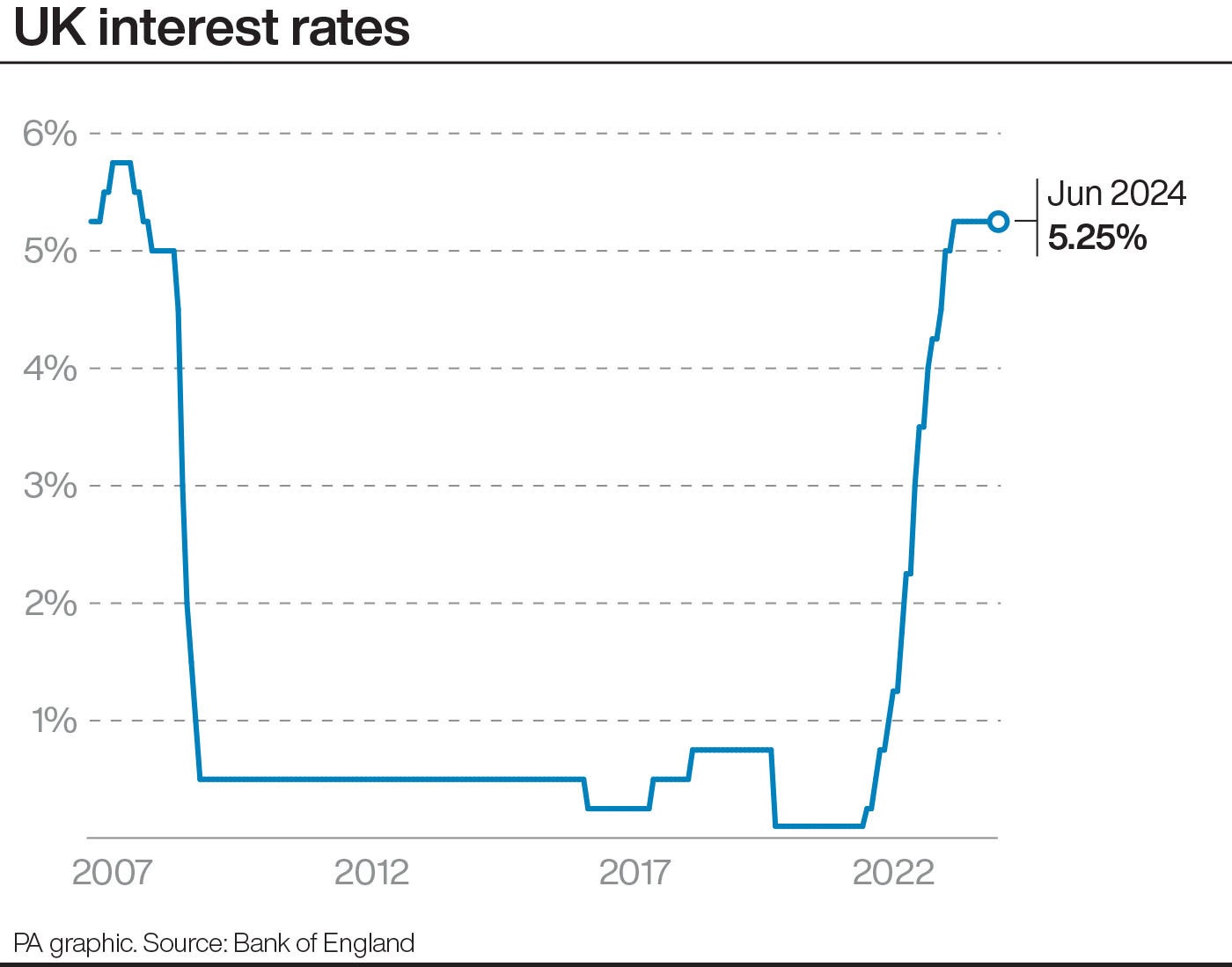

UK interest rates – which are used to help set mortgage rates and other borrowing costs – are currently at a 16-year-high of 5.25% after they were increased in a bid to tackle soaring inflation.

The MPC, which votes to set the rate, has held interest rates at this level for the past seven meetings but some economists have predicted they will cut the rate at the next vote on August 1.

It comes after CPI (Consumer Price Index) inflation dropped to the Bank’s target level of 2% in May.

Ms Dhingra, who was one of two rate-setters to vote for a cut last month, told The Rest Is Money podcast that demand in the economy is soft enough to begin cutting rates.

“I don’t see some kind of consumption boom, and if we are going to start moderating from the very high level of interest rate where we are at now – 5.25% – it is going to take some time for that to happen,” she said.

“What we’ve already seen is that consumer price inflation has been in a very firm downward trajectory.

“From my point of view, now is the time to start normalising so that we can finally stop squeezing living standards where we have been in order to try and get inflation down.

“We are weighing on living standards and that cost doesn’t need to be paid.”

Nevertheless, other policymakers have indicated they could be more cautious about rate reductions.

Huw Pill, chief economist of the central bank, said last week that there are still concerns about lingering price rises in the UK but stressed it is a matter of “when, not if” the rate will be cut.

On Monday, asked whether she expects other members of the MPC to agree in favour of a rate cut in August, Ms Dhingra said: “That’s hard to say.

“Fortunately, the direction of various indicators has been very promising and the hope would be that this year we are going to see movement downwards and we are going to be able to sustainably maintain inflation at 2%.”